Foreign Account Tax Compliance Act

.svg.png) | |

| Acronyms (colloquial) | FATCA |

|---|---|

| Enacted by | the 111th United States Congress |

| Effective | March 18, 2010 (26 USC § 6038D); December 31, 2012 (26 USC §§ 1471-1474) |

| Citations | |

| Public law | 111-147 |

| Statutes at Large | 124 Stat. 71, 97-117 |

| Codification | |

| Titles amended | 26 |

| U.S.C. sections created | 26 U.S.C. §§ 1471–1474, § 6038D |

| U.S.C. sections amended | 26 U.S.C. § 163, § 643, § 679, § 871, § 1291, § 1298, § 4701, § 6011, § 6501, § 6662, § 6677 |

| Legislative history | |

| |

The Foreign Account Tax Compliance Act (FATCA) is a 2010 United States federal law to enforce the requirement for United States persons including those living outside the U.S. to file yearly reports on their non-U.S. financial accounts to the Financial Crimes Enforcement Network (FINCEN). It requires all non-U.S. (foreign) financial institutions (FFIs) to search their records for indicia indicating U.S. person-status and to report the assets and identities of such persons to the U.S. Department of the Treasury.[1] The FATCA was the revenue-raising portion of the 2010 domestic jobs stimulus bill, the Hiring Incentives to Restore Employment (HIRE) Act,[2][3] and was enacted as Subtitle A (sections 501 through 541) of Title V of that law.

Background

FATCA was reportedly enacted for the purpose of detecting the non-U.S. financial accounts of U.S. domestic taxpayers rather than to identify non-resident U.S. citizens and enforce collections.[4] There might be thousands of resident U.S. citizens with non-U.S. assets, such as astute investors, dual citizens, or legal immigrants.[5] FATCA was enacted with the purpose of having non-U.S. financial institutions identify approximately 8.7 million U.S. citizens[6] believed to reside outside of the United States and those persons believed to be U.S. persons for tax purposes.[7][8] FATCA will also be used to help identify non-U.S. person family members and business partners who share accounts with U.S. persons. Another benefit of FATCA is that U.S.-person signatories of accounts will be identified. This feature allows the reporting of the assets of non-U.S. corporations, volunteer organizations, and any other non-U.S. entity where a U.S.-person can be identified.

FATCA is used to locate U.S. citizens (usually non-U.S. residents but also U.S. residents) and "U.S. persons for tax purposes" and to collect and store information including total asset value and social security number. The law is used to detect assets, rather than income. The law does not include a provision imposing any tax. In the law, financial institutions would report the information they gather to the U.S. Internal Revenue Service (IRS). As implemented by the intergovernmental agreements (IGAs) (discussed below) with many countries, each financial institution will send the U.S.-person's data to the local government first. For example, according to Ukraine's IGA, the U.S.-person data will be sent to U.S. via the Ukrainian government. Alternatively, in a non-IGA country, such as North Korea, only the North Korean bank will store the U.S.-person data and will send it directly to the IRS.

FATCA is used by government personnel to detect indicia of U.S. persons and their assets and to enable cross-checking where assets have been self-reported by individuals. FATCA data is used to crosscheck a U.S. person's self-reported data at the Financial Crimes Enforcement Network (FINCEN). U.S. persons, regardless of residence location and regardless of dual citizenships, are required to have self-reported their non-U.S. assets to FINCEN on an annual basis.[9] According to qualification criteria, individuals are also required to report this information on IRS information-reporting form 8938. FATCA will allow detection of persons who have not self-reported, enabling collection of large penalties.[9] FATCA allows government personnel to locate U.S. persons not living in the United States, so as to assess U.S. tax or penalties.

Under FATCA, non-U.S. (foreign) financial institutions (FFI's) are required to report asset and identify information related to suspected U.S. persons using their financial institutions.[10]

Under U.S. tax law, U.S. persons (regardless of country of residence) are generally required to report and pay U.S. federal income tax on income from all sources.[11] For example, Eritrea also taxes its non-resident citizens, although it states[12] that the tax is voluntary. The U.S. is unique in taxing not only non-resident citizens but also non-resident "U.S. Persons for Tax Purposes". The law requires U.S. citizens living abroad to pay U.S. taxes on foreign income if the foreign tax should be less than U.S. tax ("taxing up"), independently within each category of earned income and passive income.[13][14][15] For this reason, the increased reporting requirements of FATCA have had extensive implications for U.S. citizens living abroad. Taxpayer identification numbers and source withholding are also now used to enforce asset reporting requirements upon non-resident U.S. citizens. For example, mandatory withholding can be required via FATCA when a U.S. payor cannot confirm the non-U.S. status of a foreign payee.[16]

The IRS previously instituted a qualified intermediary (QI) program under Internal Revenue Code § 1441,[17] which required participating foreign financial institutions to maintain records of the U.S. or foreign status of their account holders and to report income and withhold taxes.[18] One report included a statement of a finding that participation in the QI program was too low to have a substantive impact as an enforcement measure and was prone to abuse.[19] An illustration of the weakness in the QI program was that UBS, a Swiss bank, had registered as a QI with the IRS in 2001 and was later forced to settle in the UBS tax evasion controversy with the U.S. Government for $780 million in 2009 over claims that it fraudulently concealed information on its U.S. person account holders.[19] Non-resident U.S. citizens' required self-reporting of their local assets was also found to be relatively ineffective.[20]

The Hiring Incentives to Restore Employment Act (of which FATCA is a part) was passed on party lines: It narrowly passed the House, with no Republican members voting "yes"[21] and passed the Senate with only one Democrat member voting "no".[22] President Obama (D) signed the bill into law.[23]

Senator Levin (D-MI) has stated that the U.S. Treasury loses as much as 100 billion USD annually to "offshore tax non-compliance" without stating the source of the data.[3][24] (Another source stated 40-70 billion USD without citing the source). Accurate figures on unreported income have not been supported.[25] On March 4, 2009 the IRS Commissioner Charles Shulman testified before the Subcommittee that there is no credible estimate of lost tax revenue from offshore tax abuse.[26]

Supplementing the reporting regimes already in place was stated by Senator Max Baucus (D-MT) to be a means of acquiring more financial data and raising government revenue.[27] After committee deliberation, Sen. Max Baucus and Rep. Charles Rangel (D-NY) introduced the Foreign Account Tax Compliance Act of 2009 to Congress on October 27, 2009. It was later added to an appropriations bill as an amendment, sponsored by Sen. Harry Reid (D-NV), which also renamed the bill the HIRE Act.[28] The bill was signed into law by President Obama on March 18, 2010.

A legal challenge against the constitutionality of FATCA, its IGA's, and FBAR reporting requirements was filed in a federal district court in Ohio on July 14, 2015 (see below). The case is Crawford v. U.S. Department of Treasury.[29] Arguments for an injunction against the FATCA Intergovernmental agreements were held on Sept 4, 2015.

Provisions

FATCA has these main provisions:

- The law requires non-U.S. (foreign) financial institutions, such as banks, to enter into an agreement with the IRS to search through their customer databases to identify those customers suspected of being U.S. persons, and to disclose the account holders' names, TINs, addresses, and the transactions of most types of accounts.[30] Some types of accounts, notably retirement savings and other tax-favored products, may be excluded from reporting on a country by country basis. U.S. payors making payments to non-compliant foreign financial institutions are required to "deduct and withhold from such payment a tax equal to 30 percent of the amount of such payment".[31][32] Foreign financial institutions which are themselves the beneficial owners of such payments are not permitted a credit or refund on withheld taxes, absent a treaty override.[33] Identification is done by detecting "FATCA indicia". Alternatively, a bank official who has previously gained knowledge of a person's (U.S. person) status by other means, is also required to identify that person for FATCA purposes.[34] After identification, the FFI has the responsibility to further question the individual before allowing the individual to have the identification of suspicion removed.

- To facilitate the implementation of the foregoing statutory requirement, the IRS promulgated Form W-8BEN in February 2014. The IRS requires all FFIs to require all foreign account holders to certify their foreign status on Form W-8BEN unless an intergovernmental agreement is in place to authorize an alternative method of certification.[35] In other words, all account holders of FFIs are expected to comply with FATCA reporting requirements.

- U.S. persons owning or having signatory authority of these foreign accounts or other specified financial assets must report them on a new IRS Form 8938, Statement of Specified Foreign Financial Assets, which is filed with the person's U.S. tax returns if the accounts are generally worth more than US$50,000;[36] a higher reporting threshold applies to U.S. persons who are overseas residents and joint filers.[37][38][39] Account holders would be subject to a 40% penalty on understatements of income in an undisclosed foreign financial asset.[32][40] Understatements of greater than 25% of gross income are subject to an extended statute of limitations period of 6 years.[41] It also requires taxpayers to report financial assets that are not held in a custodial account, i.e. physical stock or bond certificates.

- It changed a method where foreign investors had not been due U.S. dividends by converting them into "dividend equivalents" through the use of swap contracts.[42][43]

- FATCA increased penalties and imposed certain negative presumptions[44] on Americans whose accounts are not located in U.S.

These reporting requirements are in addition to the requirement for all U.S. persons for reporting of non-U.S. financial accounts to the U.S. Financial Crimes Enforcement Network (FinCEN);[45] this most notably includes Form 114, "Report of Foreign Bank and Financial Accounts" (FBAR) for foreign financial accounts exceeding US$10,000 required under Bank Secrecy Act regulations issued by the Financial Crimes Enforcement Network .[46]

FATCA Indicia

Banks which are performing functions according to FATCA law will be searching according to FATCA indicia, which include:[47][48]

- A U.S. place of birth

- Identification of the Account Holder as a U.S. citizen or resident

- A current U.S. residence or mailing address (including a U.S. PO box)

- A current U.S. telephone number

- Standing instructions to pay amounts from a foreign (meaning non U.S.) account to an account maintained in the United States

- A current power of attorney or signatory authority granted to a person with a U.S. address

- A U.S. "in-care-of" or "hold mail" address that is the sole address with respect to the account holder

- Special note: Others affected by FATCA include

- any non U.S. person who shares a joint account with a U.S. person or otherwise allows a U.S. person to have signatory authority on the account.

- Any business or not for profit organization that allows a U.S. person to have signatory authority on a financial account.

Revenue and cost

There are varying estimates of the revenues gained and likely cost of implementing the legislation.

Revenue

With implementation, FATCA was estimated by the United States Congress Joint Committee on Taxation to produce approximately $8.7 billion in additional tax revenue over 11 years (average $792 million a year).[49] A later analysis from Texas A&M includes an estimate that revenues would be less than $250 million USD per year ($2.5 billion USD total).[26] (Gravelle stated this to be small relative to his own estimate of $40 billion per year cost of international tax evasion.)[50]:36 "The actual annual tax revenue generated since 2009 from offshore voluntary disclosure initiatives and from prosecutions of individual’s tax evasion is running significantly lower than the JCT’s estimated annual average, at less than $400 million, and will probably result in less than that over the decade 2010 to 2020."[26] Recently, a calculation showed that $771 million of tax revenue loss from U.S. banks could nearly nullify the reported revenue gain reported by the Joint Committee.[51]

Implementation cost

The estimates of the costs to be incurred in the private sector, by the IRS, and by foreign revenue authorities are less precise. "FATCA as detailed today will bring huge implementation & processing costs and effort. This cost might have to be borne by investors & account holders. Industry members estimated increase of cost per account around USD 20-50, which is still to be proven, but does not seem unrealistic."[52] "FATCA requires major initial investment within an institution, estimated at $25,000 for smaller institutions, to $100,000 to $500,000 for most institutions and $1 million for larger firms. While a boon for the financial consultancy and IT industry, it is an extra cost that institutions would rather not have."[53]

- Global: The compliance cost to financial institutions has been roughly estimated by Forbes at US$8 billion a year,[54] approximately ten times the amount of estimated revenue raised. Based on implementation costs known in a few countries, projected costs exceed $200 billion for all the financial institutions of the world to implement FATCA. This projection excludes annual administration costs.[55] A chapter of the Chamber of Commerce estimated FATCA global implementation costs to be 1-2 trillion USD.[56]

- Canada: According to the Financial Post, the Scotia Bank in Canada has already spent[57] almost $100 million.[58][59]

- Australia: The costs in Australia are estimated to be A$255 million for implementation, and A$22.7M for each year of maintenance. Over 10 years, this totals A$482.68M.[60] With 77,000 resident US citizens (54% of whom are of dual citizenship) and known population of 24,003,100, the estimated implementation cost is A$6,270 per residing U.S. citizen, A$11,590 per U.S.-person account, or A$20.20 per capita. The most representative developed country has 661 bank accounts per 1,000 adults, and Australia has 82.1% population above 15 years old (adults). This yields an estimated 41,700 US-citizen bank customers in Australia, or a FATCA implementation cost of A$37.30 per customer. As there are 3,668 Australian FFI’s are currently registered, the average estimated FATCA cost for each is A$132,000.

The same analysis showed that costs without the IGA would be A$477M for implementation, and A$58.8M for each year of maintenance. Over 10 years, this totals A$1.066bn, which would have been A$44.40 per capita, A$81.10 per customer, A$13,800 per resident U.S. citizen, or A$25,600 per U.S.-person account. This is the only published non-IGA country cost estimation identified. Without an IGA, the estimated FATCA cost per FFI is A$291,000.

Australia only succeeded to locate only 30,000 of those US citizens (72% effectiveness) in its first FATCA submission to USA. It was determined that each located U.S. citizen bank account averaged A$160,000.[61][62]

- New Zealand: The government of New Zealand has estimated that locating approximately 21,462 resident U.S. citizens would cost the government alone about $20,600,000. That cost would equal approximately 960 NZD per resident U.S. citizen, or about 4.48 NZD per capita.[63] Country costs (including costs at the institutions) was not included in the reporting, nor was the financial impact made when the IGA was signed.[64][65] Costs to FFI's was estimated to be 100 million NZD, just to bring New Zealand into initial FATCA compliance.[66]

- Europe: The costs of implementation in Europe are shown (below) with available documentation to be greater than U.S. revenue estimates in only 3 of its countries. Implementation in UK, Germany, and Sweden alone will cost more than 10 billion USD.

- United Kingdom: The United Kingdom government has estimated that the cost to British businesses will be £1.1 billion to £2 billion for the first five years (approximately two thirds of the estimate total additional global tax revenue expected), in order to locate approximately 177,185 U.S. citizens.[67][68][69] The cost there is then approximately £6,000 to £11,000 per resident US citizen or 17-31 GBP per capita. " HMRC’ estimates its own one-off IT and staff project costs at approximately £5m, with ongoing annual costs of £1.4m from 2016."[69]

- Germany: The costs in Germany are estimate to be 386 million EUR for implementation, and 30 million EUR for each year of maintenance.[70] With 108,845 U.S. citizens residing in Germany and known population, the implementation cost is 6027 EUR per residing U.S. citizen, 10,390 EUR per U.S.-person account, 8.07 EUR per capita, or 13,91 EUR per customer.[71][72] Using Germany's own implementation estimate and the known quantity of FFI's, the implementation cost of a German FFI averages 149,000 EUR[72]

- Sweden: The Swedish government administration stated that the costs of implementation should be considered versus the threatened 30% sanctioned tax which could be applied for non-compliance.[73] Sweden could not estimate the business effect of FATCA, despite that Swedish law requires that the business impact must be evaluated for legislations.[74] In following discussions, it was estimated that each small financial institute (comprising 95% of the FFI’s) would incur 1 million SEK yearly FATCA administration costs.[75] (Documentation of the costs to larger institutions has not been located.) IRS lists 744 FFI’s to date, yielding a minimum estimated yearly cost of 744 million SEK (excludes the cost of the 5% larger institutions), or 7.44 billion SEK over 10 years.[76][77] The costs to the Swedish government were estimated to be above 15 million SEK for implementation and 15 million SEK per year thereafter, for a 10-year public cost of 165 million SEK. Total FATCA implementation costs in Sweden are estimated to be greater than 7.61 billion SEK.

With 9,784,445 inhabitants and 17,000 resident U.S. citizens, the Swedish government cost is 777 SEK per capita, 447,700 SEK per resident US-citizen resident and 937 SEK per adult Swedish account, or an astounding 539,984 SEK per adult resident U.S.-person account.

- United States: There are few reliable estimates for the additional cost burden to the U.S. Internal Revenue Service, although it seems certain that the majority of the cost seems likely to fall on the relevant financial institutions and (to a lesser degree) foreign tax authorities who have signed intergovernmental agreements.[78][79] The FATCA bill approved 800 additional IRS employees (cost estimated to be $40 – $160 million per year). According to a TIGTA report, the cost to develop the FATCA XML data website is $16.6 million (which is $2.2 million over the budgeted amount). However, "IRS also submitted a budget request of $37.1 million for funding FATCA implementation for 2013, including the costs to staff examiners and agents dedicated to enforcing FATCA, along with IT development costs. This budget request does not identify the resources needed for implementation beyond fiscal year 2013"[80] The I.R.S. "has been unable to ascertain all potential costs beyond those for IT resources." ref name="gao.gov"/>

Criticism

Certain aspects of FATCA have been a source of controversy in the financial and general press.[81] The Deputy Assistant Secretary for International Tax Affairs at the U.S. Department of the Treasury stated in September 2013 that the controversies were incorrect (myths).[82] The controversy primarily relates to several central issues:

- Cost. Robert Stack provided the Treasury position that "Treasury and the IRS have designed our regulations in a way that minimizes administrative burdens and related costs."[82] Estimates of the additional revenue raised seemed to be heavily outweighed by the cost of implementing the legislation. In March 2012 the Association of Certified Financial Crime Specialists (ACFCS) said FATCA was expected to raise revenues of approximately US$800 million per year for the U.S. Treasury with the costs of implementation more difficult to estimate. ACFCS claimed it was extremely likely that the cost of implementing FATCA, borne by the foreign financial institutions would far outweigh the revenues raised by the U.S. Treasury, even excluding the additional costs to the U.S. Internal Revenue Service for the staffing and resources needed to process the data produced.[83] Contrary to established congressional practice, FATCA was not subject to a cost/benefit analysis by the Committee on Ways and Means.[84] Perhaps not considered by Congress, the cost to the global financial institutions to implement FATCA has been reported to be range from Forbes' estimate of US$8 billion a year,[85] (approximately ten times the amount of estimated revenue raised) US$200 billion (based on per capita costs for Australia and the UK),[55] to 1-2 trillion USD (chapter of the Chamber of Commerce).[56]

- Benefits versus cost. The intention of locating U.S. persons and their non-U.S. financial accounts was to increase tax revenues from the interest, dividends, and gains of those assets. The majority of assets located was expected be the international equivalent of standard checking and savings accounts, where the applicable interest was less than 0.5% during 2015. The majority of that income is already (by tax treaty) attributable to the country where it resides. (IRS form 1116 is normally used to credit foreign taxes upon passive income). Another source of revenue where FATCA intends to raise revenue is in the identification of a wider population of U.S. persons. However, the majority (82%) of U.S. persons filing owe no tax to U.S. (due to tax treaties).[86]

- Possible capital flight. The primary mechanism for enforcing the compliance of foreign financial institutions is a punitive withholding levy on U.S. assets which the Economist speculated in 2011 might create an incentive for foreign financial institutions to divest or not invest in U.S. assets, resulting in capital flight.[87] When implementing FATCA, Congress did not publish the source of the revenue data, neither had it performed a cost/benefit analysis.

- Relevance. United States does not have a wealth tax or any other tax upon financial assets. Without a tax upon wealth, it is questioned as to why wealth is required to be reported.[88]

- Fairness. Residents of the United States have not, in general, been required to report their financial assets to the Internal Revenue Service. Non-residents are required to report asset values.[89]

- Foreign relations. Forcing foreign financial institutions and foreign governments to collect data on U.S. persons at their own expense and transmit it to the IRS has been called divisive. Canada's former Finance Minister Jim Flaherty raised an issue with this "far reaching and extraterritorial implications" which would require Canadian banks to become extensions of the IRS and would jeopardize Canadians' privacy rights.[90] There are also reports of many foreign banks refusing to open accounts for Americans, making it harder for Americans to live and work abroad.[91][92][93]

- Extraterritoriality. Robert Stack of the IRS said that extraterritoriality was incorrect (a myth) "FATCA has received considerable international support because most foreign governments recognize how effective FATCA, and in particular our intergovernmental approach, will be in detecting and combating tax evaders"[82] The legislation enables U.S. authorities to impose regulatory costs, and potentially penalties, on foreign financial institutions who otherwise have few if any dealings with the United States.[94] The U.S. has sought to ameliorate that criticism by offering reciprocity to potential countries who sign intergovernmental agreements, but the idea of the U.S. Government providing information on its citizens to foreign governments has also proved controversial.[95] The law's interference in the relationship between individual Americans or dual nationals and non-American banks led Georges Ugeux to term it "bullying and selfish."[96] The Economist called FATCA's "extraterritoriality stunning even by Washington's standards."[97]

- Differentiation by national origin and discrimination. In each country of the world, those residents which are suspected to be U.S. citizens are separated out at their financial institutions for differential treatment, based upon their place of birth and nationality.[98] Discrimination according to national origin is prohibited in most countries. For example, Article 14 of The European Convention on Human Rights specifies "Prohibition of discrimination: The enjoyment of the rights and freedoms set forth in this Convention shall be secured without discrimination on any ground such as ... national or social origin, association with a national minority, property, birth or other status."[99] Those suspected to be of U.S. nationality are treated differently than any of the other residents. Few precedents exist in the last 70 years, where any particular nationality has been searched out to be identified strictly by virtue of nationality,[100][101] Previous identifications by national characteristic have only occurred within regions. Other global instances have not been identified.

- Effect on "accidental Americans". The reporting requirements and penalties apply to all U.S. citizens, including accidental Americans, those who are unaware that they have U.S. citizenship. Since the U.S. considers all persons born in the U.S., and most foreign-born persons with American parents, to be citizens, FATCA affects a large number of foreign residents, who are unaware that the U.S. considers them citizens.[102][103]

- Effects on non-Americans. Persons who are not U.S. residents and are not U.S. persons and do not share accounts with U.S. persons still must self-certify said status when opening a bank account outside the U.S. at any FFI. According to the FATCA IGA, if such a person does not self-certify said status, that person cannot open a bank account at that institution.[104] Canada and United Kingdom have interpreted the IGA's differently and believe that non-U.S. persons who fail to self-certify shall not be refused a bank account. However, non-co-operating non-U.S. persons shall be FATCA reported in the same way as those persons who have U.S. indicia.[105][106]

- Citizenship renunciations.

- Robert Stack of the IRS presented the administration' IRS position that renunciation due to FATCA are incorrect (a myth), because: "FATCA provisions impose no new obligations on U.S. citizens living abroad." The statement ignores the FATCA self-certification processes and filings of form 8938.[82] The U.S. State Department admits that the rise of renunciation figures are related to U.S. taxation policy.[107] The State Department acknowledged the rise in relinquishments and renouncements, and expects them to rise further in the future.[108]

- In 2013, Time magazine reported a sevenfold increase in Americans renouncing U.S. citizenship between 2008 and 2011, attributing this at least in part to FATCA.[109] According to BBC Magazine, the act is one of the reasons for a surge of Americans renouncing their citizenship—a rise from 189 people in Q2/2012 to 1,131 in Q2/2013.[110] Another surge in renunciations in 2013 to record levels was reported in the news media, with FATCA cited as a factor in the decision of many of the renunciants.[111][112] According to the legal website International Tax Blog, the number of Americans giving up U.S. citizenship started to increase dramatically in 2010 and rose to 2,999 in 2013, almost six-fold the average level of the previous decade.[113] The trend continued in 2014 with 3415 people reported by the Federal Register as having given up citizenship or long-term residency.

- In 2014 Forbes wrote that the numbers of those renouncing their citizenship are understated.[114][115] According to a survey reported by Forbes, "5.5 million Americans eye giving up U.S. citizenship".[116] There are serious differences between the figures cited by the Federal Register (which include renunciations, relinquishments, and loss of long-term resident (green-card) status to the National Instant Criminal Background Check System gun control database ("NICS") which only contain renunciations.[117] Whereas the Federal Register stated that 3,415 people renounced or relinquished their citizenship or long-term residence, the IRS stated that 1,100 people renounced citizenship at only one particular U.S. consulate during the first ten months of 2014.[118][119] This contradicted prior claims that such statistics are not maintained at the consulates.[120][121]

- FY 2015: The State Department estimated 5,986 renunciants and 559 relinquishers during FY 2015[122] This is despite the 422% hike in renunciation and relinquishment fees where the FY2015 data was released to the public.

- American citizens living abroad. According to CBC.cain January 2014, many Americans living abroad might face large fines as a result of this legislation.[123] According to Time in 2013 magazine, American citizens living abroad would be unable to open foreign bank accounts.[124] The Wall Street Journal reported in July 2014 that "FATCA worsens the already profoundly unjust tax treatment of millions of middle-class Americans living abroad." "FATCA rules were intended to correct a tax loophole. Applied to Americans living abroad, they are absurd."[125][126] The Guardian reports that Americans living abroad feel financially terrorized by FATCA requirements.[127] According to research by Democrats Abroad: "These survey results show the intense impact FATCA is having on overseas Americans. Their financial accounts are being closed, their relationships with their non-American spouses are under strain, some Americans are being denied promotion or partnership in business because of FATCA reporting requirements and some are planning or contemplating renouncing their U.S. citizenship."[128][129] Robert Stack stated the IRS position that "FATCA withholding applies to the U.S. investments of FFIs whether or not they have U.S. account holders, so turning away known U.S. account holders will not enable an FFI to avoid FATCA."[82]

- Lack of reciprocity. Regarding reciprocity from USA, the model IGA states: "The Parties are committed to working with Partner Jurisdictions and the Organisation for Economic Cooperation and Development on adapting the terms of this Agreement and other agreements between the United States and Partner Jurisdictions to a common model for automatic exchange of information, including the development of reporting and due diligence standards for financial institutions." There is no U.S. legislation to allow reciprocity.[130] The president's budget for year 2014 included a proposal to allow the Treasury Secretary to collect information which could be used for FATCA reciprocity.[131] The proposal stated that its intent was to "facilitate such intergovernmental cooperation by enabling the IRS to reciprocate in appropriate circumstances"; however, the proposal did not request to allow the Secretary to have further transmittal authority. The president's federal budget proposals of 2014, 2015 and 2016 did not list either costs or revenues for reciprocity implementation in any of the coming 10 years—thus assuming that this collection was either cost neutral or, more logically, it would be interpreted as to not be budgeted in any of the coming 10 years.[132][133] The President's FY2014 budget was not enacted; rather, a different version was passed. The President's FY2015 budget was defeated in the House of Representatives on a vote of 2-413. The President's FY2016 budget was defeated in the Senate on a vote of 0-97.[134]

- Reciprocity not authorized by Congress. FATCA as implemented by Congress included no mention of reciprocity.[135] FATCA as being implemented with the Executive Branch's IGA implementation has made reciprocity promises to foreign governments.[136][137]

- The FATCA IGA is no treaty under U.S. law. A treaty requires two thirds consent in the U.S, Senate in order to become applicable in U.S. law. The applicability of IGA's is being challenged in U.S. court. The plaintiffs state that the IGA's are not valid Executive Agreements. The IGA documents are all signed by officials lower than the President. Philippines has delayed FATCA data transmittal, citing that the IGA "Treaty" has not yet been ratified by the U.S. Senate.[138]

- IRS not ready. According to The New York Times, it is unclear whether the IRS is ready to handle millions of new complicated filings per year.[45] On May 2, 2014, the IRS issued Notice 2014-33 providing that 2014 and 2015 will be regarded as a transition period for purposes of enforcement and administration relating to entity but not individual investors.[139]

- Complexity. Doubts have been expressed as to workability of FATCA due to its complexity,[140] and the legislative timetable for implementation has already been pushed back twice.[141] According to U.S. national tax advocate Nina Olsen in regards to FATCA: "This is a piece of legislation that is so big and so far-reaching, and [has] so many different moving pieces, and is rolling out in an incremental fashion (...) that you really won’t be able to know what its consequences are, intended or otherwise,’ Olson said. "I don’t think we’ll know that for years. And by that point we’ll actually be a little too late to go, "Oops, my bad, we shouldn’t have done this,’ and then try to unwind it."[142] Bloomberg reported in 2015 that the IRS help center is not able to provide adequate taxpayer customer service.[143]

- Identity theft. The IRS reports that identity thieves are using fraudulent compliance requests as a "phishing" ruse to obtain sensitive account-holder information. As of April, 2015, more than 150,000 financial institutions throughout the world are storing social security numbers and asset values of U.S. citizens.[144]

- Account Closures. Due to the costs and complexity of implementing this legislation, many banks have been excluding U.S. persons from holding financial accounts at their institutions.[145] These closures, based upon nationality, have not been halted by government authorities. In fact, the EU affirmed the practice of closure based upon nationality, by stating "Banks have the right, under the contractual freedom principle, to decide with whom they want to contract. They can in any event refuse clients for sound commercial reasons."[146][147] These closures are despite that those countries who have signed intergovernmental agreements, had also promised to not close the accounts of U.S. persons.[148]

- Additional Complexity for U.S. Persons U.S. Persons were already forbidden by the Securities Act of 1933 to make investments in U.S. Securities at banks which are not certified inside U.S.A. by the Securities and Exchange Commission. This disallows U.S. persons from participating in any product which may contain U.S. investment products. If a financial institution is not able to segregate non-U.S. investments from other investment products, a bank may place a total ban upon U.S. persons using their investment products.[149] Since non-U.S. institutions located outside U.S.A. cannot acquire sufficient competence of U.S. law, non-U.S. institutions often find no exemption allowing resident U.S. persons to purchase any financial products from their institution.[150]

- Security. As piracy, kidnapping, and global terrorism dominate the political and media climate, some thinkers have questioned the entire FATCA mentality, where non-U.S. banks and non-U.S. governments are entrusted with the private data of U.S. citizens. The following countries have been entrusted with FATCA's private data of U.S. persons: Brazil, Croatia, Israel, Kosovo, Mexico, Qatar, Uzbekistan, Algeria, Azerbaijan, Bahrain, China, Columbia, Georgia, Serbia, Thailand, Turkey, Ukraine, UAE, Angola, Cambodia, Kazakhstan, Tunisia.[151] FFI's are required via FATCA to identify U.S. persons and store their asset values and U.S. Social Security numbers. There are many countries which have been, could be, or are at war or cold war, where FFI's have implemented FATCA. There is no control over which government or which individuals at these locations have control of the identity of U.S. persons. Here are some examples of the quantity of FFI's registered in troubled areas: Afghanistan: 15, Chad: 5. China: 1,021. North Korea: 1, Nigeria: 92. Iraq: 16. Russia: 1,117. Ukraine: 217. Venezuela; 179. Yemen: 13

- Many countries have U.S. sanctions upon the country and the country's leaders and their assets. Many of those countries have FATCA programs in their banks, where U.S. person customers are being identified, such as these countries and the quantity of FFI's: Côte d'Ivoire (35) Zimbabwe (12)[76]

- Minimum requirements without limits on the upper end. FATCA has minimum standards in its methodology of finding U.S. persons. For example, the accounts with minimum end balance of 50,000 USD must be investigated with at least the U.S. indicia criteria specified. The FATCA rules do not require any FFI to not investigate or report or FATCA-process accounts as low as zero. The FFI's are not prohibited from using any indicia to identify[152] U.S. persons. There are no restrictions in FATCA regulations as to what is not allowed to be used against U.S. persons.

- Marketability of American Financial Products. European Parliament’s Economic and Monetary Affairs Committee public hearing on FATCA May 29, 2-13, Robert Stack stated ", I believe the, the members here present today and the participants understand that the United States, ah, put its markets at risk in doing FATCA"[152][153]

- Income Tax Complications. For the 2014 tax year, National Bank of Canada Inc. issued 1099's for investments to US residents that only covered the 6 months prior to FATCA. With a 1099 in hand, many residents filed income taxes not knowing the 1099 was incomplete. Subsequent years without 1099's leave residents guessing whether their dividends are 'qualified' for tax purposes.

- FATCA and human rights. In a 2016 paper academics argue that tax evasion can be directly linked to violations of human rights. That situation must be balanced against the risk that collection techniques violate other human rights like privacy and the legitimate protection of trade secrets.[154]

- FATCA and the European Union: Robert Stack of the IRS stated the administration position that it was incorrect (a myth) "that legislation could force foreign banks to violate laws in their own countries: [Instead,] Treasury’s decision to implement FATCA through IGAs that are respectful of the individual laws and customs of partner jurisdictions has contributed to the significant international interest in participating in FATCA compliance efforts."[82]

- Privacy and data protection legislation in Europe. Civil rights such as the right to privacy, or the right to data protection as a taxpayer are said to be compromised. There is no provision in FATCA for the protection of taxpayer rights, complains legal researcher Leopoldo Parada.[155] The association of data protection supervisors is working on the case.[156] As for other data protection legislation in Europe, for instance, the Swedish law Personuppgiftslagen (PUL) or personal data law, requires (unforced) consent of the individual in order to send data to a third country.[157] The need for the information must also be greater than the need for the persons integrity.[158] It is forbidden to deliver data that is not protected to a level adequate to EU standard[159]

- FATCA and the ECHR: All of parties to the European Convention of Human Rights (which includes all EU member states) are bound by its provisions including the interpretation through the case law of the European Court of Human Rights. Each law must have respect for an individual's private life except in cases of the state's or population safety, or the country's economic health.[160] FATCA's data is not used for the benefit of any EU member state. An EU member's economic health is not improved by FATCA, it only avoids the threatened 30% tax sanctions by complying with FATCA.[161]

- E.U. requirements limiting data-sharing. FATCA does not fulfill the E.U. requirements limiting data-sharing which allow sharing to be done only with organizations following the (now invalidated)[162] Safe Harbor Principles.[163] The IRS is not listed as meeting this demand.[164][165]

- E.U. member state requirements that bank accounts be opened. Many EU countries require banks to open accounts for applicants (because this is the only method to receive salary). FATCA's mechanism to close bank accounts if FATCA demands are not met violates such laws (see insättnings garanti in Sweden).[166] New FATCA IGA requirements demand that banks shall not open accounts for U.S. persons or accounts for non-U.S. persons if the individual refuses to declare U.S.-person status upon bank account applications.[167]

Opposition

Republican National Committee

On January 24, 2014, the Republican National Committee passed a resolution calling for the repeal of FATCA.[168]

American expatriates

American Citizens Abroad, Inc., (ACA) a not-for-profit organization claiming to represent the interests of the millions of Americans residing outside the United States, asserts that one of FATCA's problems is citizenship-based taxation (CBT). Originally ACA called for the U.S. to institute residence-based taxation (RBT) to bring the United States in line with all other OECD countries.[169] Later in 2014 two ACA directors commented on the situation of Boris Johnson.[170] In 2015, ACA decided on a more refined stance.[171]

In March 2015 the United States Senate Committee on Finance sought public submissions to a number of Tax Reform Working Groups.[172] Over 70 percent of all submissions to the International Taxation Working Group[173] and close to half of all submissions to the Individual Taxation Working Group[174] came from individual U.S. expatriates, many citing specific consequences of FATCA in their countries of residence, and nearly all calling both for residence-based taxation and the repeal of FATCA.

Legal challenge

As reported in the Washington Times,[175] a legal challenge has been launched by attorney James Bopp. The suit is backed by a group called Republicans Overseas (RO), based on the assertion that FATCA violates the Senate's power with respect to treaties, an 8th Amendment Excessive Fines claim, and a 4th Amendment Search and Seizure claim.[176][177] Kentucky Sen. Rand Paul is among the individuals suing the U.S. Treasury and the Internal Revenue Service.[178] The case is Crawford v. U.S. Department of Treasury, and includes seven plaintiffs. Republicans Overseas is led by members of the rules committee of the Republican National Committee including Bruce Ash and Solomon Yue. The specific claims being advanced in the legal challenge are as follows:

- Count 1: The IGAs are Unconstitutional Sole Executive Agreements, Because they Exceed the Scope of the President's Executive Powers;

- Count 2: The IGAs are Unconstitutional Agreements, Because They Override FATCA

- Count 3: The Heightened Reporting Requirements for Foreign Financial Accounts Deny U.S. Citizens Living Abroad the Equal Protection of the Laws;

- Count 4: The FATCA FFI Penalty is Unconstitutional under the Excessive Fines Clause;

- Count 5: The FATCA Pass-through Penalty is Unconstitutional under the Excessive Fines Clause;

- Count 6: The FBAR Willfulness Penalty is Unconstitutional under the Excessive Fines Clause;

- Count 7: FATCA's Information Reporting Requirements are Unconstitutional under the Fourth Amendment;

- Count 8: The IGAs' Information Reporting Requirements are Unconstitutional under the Fourth Amendment.

An injunction is also sought against FATCA's asset reporting requirements on Form 8966 and on the form for the report of Foreign Bank and Financial Accounts (FBAR). The plaintiffs declare that these requirements violate the constitution and that the government should not be allowed to enforce them.[179][180]

Another challenge was filed in the Northern District of California by a pro se litigant in Alsheikh v Lew et al., which has the case number 3:15-cv-3601 JST. The plaintiff challenges FATCA on 10th, 4th and 5th Amendment bases.

Canadians, particularly those considered to be American persons for taxation purposes

An organization called the Alliance for The Defence of Canadian Sovereignty is challenging a Canadian law that implements FATCA. The organization claims that the Canadian law violates the Canadian Charter of Rights & Freedoms, particularly the provisions related to discrimination on the basis of citizenship or national origin.[181] This is not technically a direct opposition to FATCA — as the United States Congress has no legislative authority over Canada — but is instead an opposition to the parallel Canadian federal legislation.[182] On August 11, 2014, in an action supported by the Alliance for the Defence of Canadian Sovereignty, two Canadian citizens filed suit in the Federal Court of Canada challenging the constitutionality of the Canadian law that implements FATCA in Canada. Both of the citizens were born in the United States, with at least one Canadian parent, but they returned to Canada in childhood and have had no residential ties to the United States since that time. They state that this would result in them having U.S. indicia, and therefore being discriminated against by Canadian banks.[183][184] On August 12, 2014, Canadian government spokesman Jack Aubry defended the constitutionality of the legislation, but otherwise declined to comment on the pending litigation.[185]

A Canadian Federal Court ruling would not involve jurisdiction over the relationship of United States citizens with the United States Government, but would affect those individuals' rights as Canadians. Such a ruling would therefore be a finding of unconstitutionality as a matter of Canadian constitutional law, as to the two litigants. It would allow a remedy under Canadian law, but would not relieve them of their responsibilities to the United States under FATCA, as United States citizens. Thus, such a ruling would not remove the effect of the provisions of FATCA on U.S. citizen-taxpayers, no matter where their bona fide non-U.S. tax home is located. However, a human rights complaint submitted to the United Nations, by members of The Isaac Brock Society[186] and Maple Sandbox,[187] that the U.S. system of taxation, and requirements, compliance reporting, and excessive penalties therewith, of its citizens tax resident in other countries including taxation of their income and assets in those countries, represents violation of their human rights. This complaint is suggestive that such taxation violates the IRS Taxpayer Bill of Rights provision #10 "The Right to a Fair and Just Tax System."[188][189]

On October 7, 2014, the legal claim by the Alliance for the Defence of Canadian Sovereignty was amended to include the allegation that the FATCA IGA and enabling legislation are in violation of both the Income Tax Act of Canada and the Canada U.S. Tax Treaty.[190]

Implementation

Domestic

FATCA added 26 U.S.C. § 6038D (section 6038D of the Internal Revenue Code) which requires the reporting of any interest in foreign financial assets over $50,000 after March 18, 2010. FATCA also added 26 U.S.C. §§ 1471–1474 requiring U.S. payors to withhold taxes on payments to foreign financial institutions (FFI) and nonfinancial foreign entities (NFFE) that have not agreed to provide the IRS with information on U.S. accounts. FATCA also added 26 U.S.C. § 1298(f) requiring shareholders of a passive foreign investment company (PFIC) to report certain information.

The U.S. Department of the Treasury issued temporary and proposed regulations on December 14, 2011 (26 C.F.R. 1.6038D-0T et seq.) for reporting foreign financial assets, requiring the filing of Form 8938 with income tax returns.[191][192] The Department of the Treasury issued final regulations and guidance on reporting interest paid to nonresident aliens on April 16, 2012 (26 C.F.R. 1.6049-4 et seq., 26 C.F.R. 31.3406(g)-1).[193] Treasury issued proposed regulations regarding information reporting by, and withholding of payments to, foreign financial institutions on February 8, 2012,[194][195][196] and final regulations on January 17, 2013 (26 C.F.R. 1.1471-0 et seq.).[197][198] On December 31, 2013 the IRS published temporary and proposed regulations (26 C.F.R. 1.1291-0T et seq.) on annual filing requirements for shareholders of PFICs.[199] On February 20, 2014, the IRS issued temporary and proposed regulations making additions and clarifications to previously issued regulations and providing guidance to coordinate FATCA rules with preexisting requirements.[200][201]

On April 2, 2014, the U.S. Department of the Treasury extended from April 25, 2014 to May 5, 2014 the deadline by which an FFI must register with the IRS in order to appear on the initial public list of "Global Intermediary Identification Numbers" (GIINs) maintained by the IRS, also known as the "FFI List."[202][203] In June 2014, the IRS began publishing a monthly online list of registered FFIs, intended to allow withholding agents to verify the GIINs of their payees in order to establish that withholding is not required on payments to those payees.[204]

International implementation

Implementation of FATCA may involve legal hurdles; it may be illegal in foreign jurisdictions for financial institutions to disclose the required account information.[205] There is a controversy about the appropriateness of intergovernmental agreements (IGAs) to solve any of these problems.[206][207]

France, Germany, Italy, Spain, and the United Kingdom announced in 2012 they consented to cooperate with the U.S. on FATCA implementation,[208][209] as did Switzerland, Japan[210] and South Africa.

The deputy director general of legal affairs of the People's Bank of China, the central bank of the People's Republic of China, Liu Xiangmin said "China's banking and tax laws and regulations do not allow Chinese financial institutions to comply with FATCA directly."[211] The U.S. Department of the Treasury suspended negotiations with Russia in March 2014.[212] Russia, while not ruling out an agreement, requires full reciprocity and abandonment of US extraterritoriality before signing an IGA.[213][214] Russian President Vladimir Putin signed a law on June 30, 2014 that allowed Russian banks to transfer FATCA data directly to US tax authorities—after first reporting the information to the Russian government.[215] Russian banks are required to obtain client consent first but can deny service if that consent is not given.[216] Bangladeshi banks, which have accounts of US taxpayers, may report to the IRS, However they need prior approval of their clients.[217]

A 2014 Swiss referendum against the act did not come to fruition.[218]

Intergovernmental agreements

As passed by Congress, FATCA was meant to form the basis for a relationship between the U.S. Department of the Treasury and individual FFI's. Personnel at some FFIs responded by asserting,[219] however, that it was not possible to follow for the FFIs to follow their own countries' laws (privacy, confidentiality, discrimination, etc.) and simultaneously to comply with FATCA as is.[220][221] Discussions from financial industry lobbyists resulted in the creation of Intergovernmental Agreements (IGA's) between the Executive Branch of the United States government with foreign governments.[52] This development resulted in foreign governments to implement the US FATCA requirements into their own legal systems, which in turn allowed those governments to change their privacy and discrimination laws[222] to allow the identification and reporting of US persons via those governments.[222] In an IGA, a government agrees that all of its financial institutions shall comply with FATCA (whereas without the IGA each FFI would have been able to decide if it were to comply with FATCA or not). With the IGA's, the private data of suspected US persons would be collected and handled by the FFI's, whereas the many governments would then collect and store that data for further transmittal. The IGA added the applicable government to the list of handlers of the data.

The United States Department of the Treasury has published model IGAs which follow two approaches. Under Model 1, financial institutions in the partner country report information about U.S. accounts to the tax authority of the partner country. That tax authority then provides the information to the United States. Model 1 comes in a reciprocal version (Model 1A), under which the United States will also share information about the partner country's taxpayers with the partner country, and a nonreciprocal version (Model 1B). Under Model 2, partner country financial institutions report directly to the U.S. Internal Revenue Service, and the partner country agrees to lower any legal barriers to that reporting.[223] Model 2 is available in two versions: 2A with no Tax Information Exchange Agreement (TIEA) or Double Tax Convention (DTC) required, and 2B for countries with a pre-existing TIEA or DTC. The agreements generally require parliamentary approval in the countries they are concluded with, but the United States is not pursuing ratification of this as a treaty.

In April 2014, the U.S. Department of the Treasury and IRS announced that any jurisdictions that reach "agreements in substance" and consent to their compliance statuses being published by the July 1, 2014, deadline would be treated as having an IGA in effect through the end of 2014, ensuring no penalties would be incurred during that time while giving more jurisdictions an opportunity to finalize formal IGAs.[202][223]

In India the Securities and Exchange Board of India (SEBI) said "FATCA in its current form lacks complete reciprocity from the US counterparts, and there is an asymmetry in due-diligence requirements." Furthermore, "Sources close to the development say the signing has been delayed because of Indian financial institutions' unpreparedness."[224]

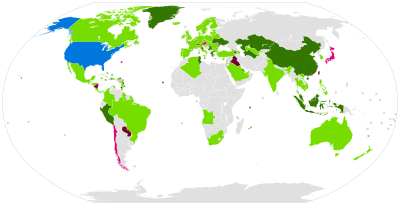

With Canada's agreement in February 2014, all G7 countries have signed intergovernmental agreements. As of November 28, 2016, the following jurisdictions have concluded intergovernmental agreements with the United States regarding the implementation of FATCA, many of which have not entered into force.[223]

| Jurisdiction | Type | Signature | Entry into force | Approval process partner state |

|---|---|---|---|---|

| | 1 | October 13, 2015 | ||

| | 1 | November 9, 2015 | ||

| | 1 | August 31, 2016 | ||

| | 1 | April 28, 2014 | June 30, 2014[225] | |

| | 2 | April 29, 2014 | December 9, 2014[226] | |

| | 1 | September 9, 2015 | November 5, 2015[227] | |

| | 1 | November 3, 2014 | September 17, 2015[227] | |

| | 1 | November 17, 2014 | September 25, 2015[227] | |

| | 1 | March 18, 2015 | July 29, 2015[227] | |

| | 1 | April 23, 2014 | ||

| | 2 | December 19, 2013 | August 19, 2014[226] | |

| | 1 | September 23, 2014 | June 26, 2015 | |

| | 1 | June 30, 2014 | July 13, 2015 | |

| | 1 | December 5, 2014 | June 30, 2015[227] | |

| | 1 | September 14, 2015 | ||

| | 1 | February 5, 2014 | June 27, 2014[228] | Implementation act published.[229] |

| | 1B[230] | November 29, 2013 | July 1, 2014[226] | |

| | 2 | March 5, 2014 | ||

| | 1 | May 20, 2015 | August 27, 2015 | |

| | 1A[230] | November 26, 2013 | ||

| | 1 | March 20, 2015 | ||

| | 1 | December 16, 2014 | August 3, 2016 | |

| | 1 | December 2, 2014 | September 21, 2015 | |

| | 1 | August 4, 2014 | December 18, 2014 | |

| | 1 | November 19, 2012 | September 30, 2015[227] | Implementation law L67 passed December 20, 2013.[231] Draft implementation regulation published, hearing ends May 8, 2014.[232] Due diligence deadlines June 30, 2015, and June 30, 2016.[233] |

| | 1 | September 15, 2016 | ||

| | 1 | April 11, 2014 | July 9, 2014[226] | |

| | 1 | March 5, 2014 | February 20, 2015[227] | |

| | 1 | November 14, 2013 | October 14, 2014[226] | |

| | 1 | July 10, 2015 | September 18, 2015 | |

| | 1 | May 31, 2013 | December 11, 2013[234] | |

| | 1 | May 8, 2014 | September 17, 2015[227] | |

| | 1 | December 13, 2013 | August 26, 2015 | Draft implementation regulation published.[235] |

| | 1 | August 29, 2016 | ||

| | 1 | March 31, 2014 | February 19, 2015[227] | |

| | 2 | November 13, 2014 | July 6, 2016 | |

| | 1 | February 4, 2014 | July 16, 2014[226] | |

| | 1 | May 26, 2015 | September 22, 2015[227] | |

| | 1 | July 9, 2015 | August 31, 2015[227] | |

| | 1 | January 23, 2013 | April 2, 2014 | |

| | 1 | December 13, 2013 | August 26, 2015 | Draft implementation regulation published.[235] |

| | 1 | June 30, 2014 | August 29, 2016 | |

| | 1 | January 10, 2014 | August 17, 2015[227] | |

| | 1 | May 2, 2014 | September 24, 2015 | |

| | 2 | June 11, 2013 | June 11, 2013 | |

| | 1 | December 13, 2013 | October 28, 2015[227] | Draft implementation regulation published.[235] |

| | 1 | February 26, 2015 | November 4, 2015 | |

| | 1 | April 29, 2015 | January 28, 2016 | |

| | 1 | June 27, 2014 | December 15, 2014[226] | |

| | 1 | May 19, 2014 | January 22, 2015[227] | |

| | 1 | August 26, 2014 | October 7, 2014 | |

| | 1 | March 28, 2014 | July 29, 2015[227] | |

| | 1A[236] | December 16, 2013 | June 26, 2014[226] | |

| | 1 | December 27, 2013 | August 29, 2014[226] | |

| | 1 | November 19, 2012 | January 1, 2013[237] | Replaced by revised treaty on April 9, 2014, with no break in enforcement.[238] |

| | 2 | November 26, 2014 | January 21, 2016 | |

| | 1 | September 8, 2015 | ||

| | 1A[239] | December 18, 2013 | April 9, 2015[240] | |

| | 1 | June 12, 2014 | July 3, 2014[241] | |

| | 1 | April 15, 2013 | January 27, 2014[226] | |

| | 1 | April 27, 2016 | October 25, 2016 | |

| | 1 | July 13, 2015 | ||

| | 1 | October 7, 2014 | July 1, 2015 | |

| | 1 | August 6, 2015 | ||

| | 1 | January 7, 2015 | June 23, 2015[227] | |

| | 1 | May 28, 2015 | November 3, 2015 | |

| | 1 | August 31, 2015 | April 28, 2016 | |

| | 1 | November 19, 2015 | September 1, 2016 | |

| | 1 | August 18, 2015 | May 13, 2016 | |

| | 2 | October 28, 2015 | August 30, 2016 | |

| | 1 | November 15, 2016 | ||

| | 1 | December 9, 2014 | March 28, 2015 | |

| | 1 | July 31, 2015 | November 9, 2015 | |

| | 1 | June 2, 2014 | July 1, 2014[226] | |

| | 1 | June 9, 2014 | October 28, 2014[226] | |

| | 1 | June 10, 2015 | September 8, 2016 | |

| | 1 | May 14, 2013 | December 9, 2013[242] | |

| | 1 | August 8, 2014 | March 1, 2015 | |

| | 2[243] | February 14, 2013 | June 2, 2014[218] | Parliamentary approval obtained;[244] insufficient supporters for a referendum.[245] |

| | 1 | March 4, 2016 | ||

| | 1 | August 19, 2016 | ||

| | 1 | July 29, 2015 | ||

| | 1 | December 1, 2014 | July 25, 2016 | |

| | 1 | June 17, 2015 | ||

| | 1A | September 12, 2012 | August 11, 2014[lower-alpha 1] | |

| | 1 | April 3, 2015 | ||

| | 1 | June 10, 2015 | June 10, 2015[227] | |

| | 1 | April 1, 2016 | July 7, 2016 |

- ↑ In the UK, formal approval of treaties before ratification is not requirement, although according to the Constitutional Reform and Governance Act 2010, they need to be presented to Parliament with an explanatory memorandum, which the government did in September 2012.

The following jurisdictions have also reached "agreements in substance":[223]

Model 1

Model 1

Model 1

Model 2

Delays in implementation of IGAs

Many jurisdictions are required to have their IGAs in effect and start exchange of information by 30 September 2015. The US IRS has issued Notice 2015-66, which relaxes the deadline for countries which have signed Model 1 IGAs "to hand over information regarding accounts held by U.S. taxpayers",[246][247] if the jurisdiction requests more time and "provides assurance that the jurisdiction is making good faith efforts to exchange the information as soon as possible."[246]

Implementation is noted as delayed in the following countries:

- Croatia "The Croatian tax authority announced September 10 (2015) that it would not implement reporting provisions of the intergovernmental agreement it signed with the United States by the September 30 deadline in the IGA but that Croatia would not be subject to the withholding tax."[248]

- Philippines "The mandatory reporting of financial information on US nationals by local financial institutions, as required under the new treaty on Foreign Account Tax Compliance Act (Fatca) between the Philippines and the US, has been moved to the second quarter of 2016. Internal Revenue Commissioner Kim Jacinto-Henares has advised Philippine financial institutions that the required reporting of financial information on US nationals will not take place on September 30, as originally intended. The deferment was because the intergovernmental agreement (Iga) on Fatca has yet to be ratified by the Senate as a treaty." It is known (see above) that the treaty is not ratified by the US Senate, but it is not determined in the text if Philippines has ratified the FATCA IGA in its own Senate.[249]

- Belgium "the Belgian Ministry of Finance orally confirmed that the IRS agreed to delay the FATCA reporting deadline. Belgian financial institutions now will have until the 10th day following the publication of the Belgian FATCA law into the Belgian official gazette to report their 2014 FATCA information to the Belgian tax authorities. The Belgian FATCA law is expected to be voted on before 2015 year-end."[250][251]

Related international regulations

In 2014, the OECD introduced its Common Reporting Standard (CRS) proposed for the automatic exchange of information (AEOI) through its Global Forum on Transparency and Exchange of Information for Tax Purposes. The G-20 gave a mandate for this standard, and its relation to FATCA is mentioned on page 5 of the OECD's report.[252] Critics immediately dubbed it "GATCA" for Global FATCA.[253] Ironically however, so far the US has refused to sign up to CRS.[254]

The Common Reporting standard requires each signatory country to gather the full identifying information of each bank customer, including additional nationalities and place of birth. Prior to the implementation of CRS, there had been no other method of fully and globally identifying immigrants and emigrants and citizens by way of their identification numbers, birthplaces, and nationalities. Each participating government is tasked with collecting and storing the data of all its citizens and immigrants and of transferring the data automatically to participating countries. CRS is capable of transmitting person data according to the demands of either Residence Based Taxation or Citizenship Based Taxation (CBT) or Personhood-Based Taxation.

Renunciation of citizenship

The number of Americans renouncing their citizenship has risen each year since the enactment of the FATCA, from just 1,006 in 2010 to 3,415 in 2014[255] and 4,279 in 2015.[256] Among those who renounced their citizenship was the Mayor of London, Boris Johnson, who did so after the IRS taxed the sale of his house in London.[255] Due to the rise in applications and resulting backlog, the fee for renouncing citizenship was raised by roughly 400 percent in 2015 to $2,350.[256]

See also

- Common Reporting Standard, dubbed the Global Account Tax Compliance Act (GATCA)

- European Union withholding tax

- Extraterritorial jurisdiction#United States

- FATCA agreement between Canada and the United States

- Financial Secrecy Index

- Foreign earned income exclusion

- Income tax in the United States

- International taxation#Citizenship

References

Notes

- ↑ Sec ii B 1 AGREEMENT BETWEEN THE GOVERNMENT OF THE UNITED STATES OF AMERICA AND THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND TO IMPROVE INTERNATIONAL TAX COMPLIANCE AND TO IMPLEMENT FATCA

- ↑ "The Foreign Account Tax Compliance Act (FATCA)" (PDF). DLA Piper.

- 1 2 111 Cong. Rec. S1635-36 (daily ed. Mar 17, 2010) (statement of Sen. Levin) ("Right now, thousands of U.S. tax dodgers conceal billions of dollars in assets within secrecy-shrouded foreign banks, dodging taxes and penalizing those of us who pay the taxes we owe. The Permanent Subcommittee on Investigations... estimated that these tax-dodging schemes cost the Federal Treasury $100 billion a year.")

- ↑ Crassweller, Kary; Andrew C. Liazos, Todd A. Solomon, McDermott Will & Emery (22 March 2013). "What You Need to Know About Foreign Account Tax Compliance Act's (FATCA) Impact on Non-U.S. Retirement Plans". The National Law Review. ISSN 2161-3362. Retrieved 19 March 2014. (According to one commentator, Congress enacted FATCA "to make it more difficult for U.S. taxpayers to conceal assets held in offshore accounts")

- ↑ 111 Cong. Rec. S1635-36 (daily ed. Mar 17, 2010) (statement of Sen. Levin) ("Right now, thousands of U.S. tax dodgers conceal billions of dollars in assets within secrecy-shrouded foreign banks, dodging taxes and penalizing those of us who pay the taxes we owe. The Permanent Subcommittee on Investigations... estimated that these tax-dodging schemes cost the Federal Treasury $100 billion a year.")

- ↑ "Definition of YUK".

- ↑ "What is a US Person for IRS tax purposes? - US Tax & Financial Services".

- ↑ "Classification of Taxpayers for U.S. Tax Purposes".

- 1 2 "Report of Foreign Bank and Financial Accounts (FBAR)".

- ↑ Bogaard, Jonathan H.; Michael E. Draz; Vedder Price (14 March 2013). "What...The FATCA (Foreign Account Tax Compliance Act)?". The National Law Review. ISSN 2161-3362. Retrieved 19 March 2014.

- ↑ See generally 26 U.S.C. § 61, § 6012

- ↑ "Eritrean Regime: 2% Dues Neither Mandatory, Nor An 'Income' Tax - Awate".

- ↑ Fitz-Morris, James (November 25, 2013). "Canadian banks to be compelled to share clients' info with U.S.". CBC News.

- ↑ Harvey, J. Richard (February 2014). "Worldwide Taxation of U. S. Citizens Living Abroad: Impact of FATCA and Two Proposals" (PDF). George Mason Journal of International Commercial Law. 4 (3): 319–357.

- ↑ Rousslang, Donald. "Tax Topics: Foreign tax credit". www.taxpolicycenter.org. Retrieved September 7, 2014.

- ↑ See 26 U.S.C. § 1441.

- ↑ 26 U.S.C. § 1441

- ↑ U.S. Government Accountability Office (GAO), Offshore Financial Activity Creates Enforcement Issues for IRS: Testimony Before the Committee on Finance, U.S. Senate, March 17, 2009 (statement of Michael Brostek, Director, Strategic Issues Team) at 10, [hereinafter "GAO Report"]

- 1 2 GAO Report at 10-11

- ↑ GAO Report at 5 (referring to the FBAR filing requirements of non-resident US citizens to the Financial Crimes Enforcement Network)

- ↑ "On Concurring in Senate Amendment with an Amendment: H R ... -- House Vote #991 -- Dec 16, 2009".

- ↑ "H.R. 2847 (111th): Hiring Incentives to Restore Employment Act -- Senate Vote #55 -- Mar 17, 2010".

- ↑ SpainAmericanBarAsso (October 14, 2014). "Obama Signing FATCA on March 18, 2010" – via YouTube.

- ↑ http://www.fas.org/sgp/crs/misc/R40623.pdf

- ↑ "Government "Stats" Strike Again".

- 1 2 3 "Cayman Financial Review :: Is FATCA chasing a leprechaun and his pot of gold?".

- ↑ 111 Cong. Rec. S10,778 (statement of Sen. Max Baucus) ("This bill [S. 1934] would improve tax compliance without raising taxes on anyone. These are taxes that are already legally owed.")

- ↑ 111 Cong., S.A. 3310

- ↑ Crawford v. U.S. Department of Treasury, case no. 15-cv-00250-TMR, U.S. District Court, Southern District of Ohio (Dayton).

- ↑ 26 U.S.C. § 1471(c)(1)

- ↑ 26 U.S.C. § 1471

- 1 2 Bell, Kay (March 23, 2010). "Jobs bill includes tax changes". MSNBC.

- ↑ 26 U.S.C. § 1474(b)(2)

- ↑ osneymedia (April 13, 2013). "IRS live video stream & Q&A - post final FATCA Regulations" – via YouTube.

- ↑ Internal Revenue Service (2014). "Instructions for the Requester of Forms W–8BEN, W–8BEN–E, W–8ECI, and W–8EXP, and W–8IMY" (PDF). U.S. Department of the Treasury. p. 5. Retrieved 5 August 2015.

[R]equest Form W-8BEN if you are a ... FFI required to establish the foreign status of an individual account holder for chapter 4 purposes or under the requirements of an applicable IGA[.]

- ↑ 26 U.S.C. § 6038D(a)

- ↑ Wargo, Dave (August 15, 2014). "FATCA: Expat Bank Accounts Are Being Sent Home".

- ↑ e.g., 26 C.F.R. 1.6038D-2T(a)

- ↑ Internal Revenue Service (January 15, 2013). "Do I need to file Form 8938, 'Statement of Specified Foreign Financial Assets'?".

- ↑ 26 U.S.C. § 6662(j)(3)

- ↑ 26 U.S.C. § 6501(e)(1); the limitations period was presumably extended because it was determined that international audit cases can take an additional 500 days to fully investigate. GAO Report at 1.

- ↑ 26 U.S.C. § 871(m); dividends such as those paid by a U.S. corporation became "U.S. source" and therefore subject to the 30% withholding tax for foreign payees. 26 U.S.C. § 871(1)(A), § 861(a)(2). The previous method was based on reclassifying the payment as income derived from the residence of the foreign payee and therefore the payment was not due U.S. taxation.

- ↑ Morgenson, Gretchen (March 26, 2010). "Death of a Loophole, and Swiss Banks Will Mourn". The New York Times.

- ↑ "LEVELING THE PLAYING FIELD: CURBING TAX HAVENS AND REMOVING TAX INCENTIVES FOR SHIFTING JOBS OVERSEAS". May 4, 2009.

- 1 2 Jolly, David; Knowlton, Brian (December 26, 2011). "Law to Find Tax Evaders Denounced". The New York Times.

- ↑ 31 C.F.R. 1010

- ↑ "Who is a U. S. person ( or has U.S. indicia) according to the IRS - Maple Sandbox".

- ↑ Agreement between the Government of the United States of America and the Government of Sweden to Improve International Tax Compliance and to Implement FATCA

- ↑ Joint Committee on Taxation, JCS-6-10, Estimated Revenue Effects of the Revenue Provisions Contained in an Amendment to the Senate Amendment to the House Amendment to the Senate Amendment to H.R. 2847, the Hiring Incentives to Restore Employment Act. Referenced: "Why FATCA is Bad for America and Why it Should be Repealed". ACA Reports series. American Citizens Abroad. July 19, 2012. Archived from the original on June 1, 2013.

- ↑ Gravelle JG. (2013). Tax Havens: International Tax Avoidance and Evasion. CRS

- ↑ "Senate Finance Committee Submissions: Republicans Overseas".

- 1 2 "FATCA FAQ".

- ↑ "FATCA - Region preparing for Uncle Sam". April 30, 2014.

- ↑ Wood, Robert W. (November 30, 2011). "FATCA Carries Fat Price Tag". Forbes.

- 1 2 Twain, Mark (October 20, 2014). "#FATCA Global Implementation Costs Revealed (Cross Post, Guest post)".

- 1 2 http://www.amcham.ch/members_interests/p_business_ch.asp?s=7&c=1

- ↑ "TIGTA's FATCA Report – Is the FATCA portal development better than that of the federal medical insurance exchange?". December 10, 2013.

- ↑ Greenwood, John (October 23, 2013). "Electronic spying 'a big issue' for banks, Scotia CEO Waugh says". Financial Post.

- ↑ Swanson, Lynne (September 17, 2013). "Dual Canadian-American citizens: We are not tax cheats". Financial Post.

- ↑ "TAX LAWS AMENDMENT (IMPLEMENTATION OF THE FATCA AGREEMENT) BILL 2014 Explanatory Memorandum".

- ↑ "Subscribe to The Australian".

- ↑ "#Australia funds America's #FATCA #Ethnic Identification System". February 19, 2016.

- ↑ http://www.treasury.govt.nz/downloads/pdfs/b14-info/b14-2828155.pdf

- ↑ renounceuscitizenship (December 4, 2013). "#FATCA Chronicles in New Zealand".

- ↑ "Inland Revenue does not consider it is possible to estimate the fiscal costs/benefits of entering into an IGA with the United States?"

- ↑ "FATCA attack - Economia".

- ↑ "The cost of complying with FATCA". Lexology. June 3, 2013.

- ↑ "The real cost of FATCA implementation - Eureka Blog". July 22, 2014.

- 1 2 "The cost of complying with FATCA – similar initiatives to follow? - Lexology".

- ↑ Greive, Martin; Kaiser, Tina (August 16, 2014). "US-Steuerabkommen Fatca ist eine Einbahnstraße" – via Welt Online.

- ↑ "Ausländeranteil in Deutschland bis 2015 - Statistik".

- 1 2 "Did #Obama's #FATCA shake 8 EUR out of every #German pocket?". February 14, 2016.

- ↑ Regeringens kommentar på remissinstansernas slutsatser gällande den ekonomiska och administrativa börda lagstiftningen medför är att det borde ses i ljuset av den 30-procentiga källskatt som påförs alla betalningar med amerikansk källa till svenska finansiella institut. Regeringen menar att bördan de finansiella instituten råkar ut för är försumbar i jämförelse med effekten en eventuell källskatt kommer ha på Sveriges ekonomi.

- ↑ Regelrådet anser att konsekvensutredningen inte uppfyller de krav som ställs i 6 och 7 §§ förordningen (2007:1244) om konsekvensutredning vid regelgivning.

- ↑ Enligt en högst spekulativ uträkning gjord i promemorian skulle enbart inlämnandet av kontrolluppgifter till Skatteverket innebära en löpande administrativ kostnad på en miljon kronor var för varje mindre finansiellt institute

- 1 2 "Fatca Lookup Search Page".

- ↑ "#SWeden: #America's New #Taxhaven??? ..... Will the #FATCA #racists fulfill their destiny?". February 22, 2016.

- ↑ "In order to improve FATCA implementation... we recommend that the Commissioner of Internal Revenue take the following (action) ... • establish and document a timeline for completing a comprehensive FATCA cost estimate." G.A.O.Report to the Committee on Finance, U.S. Senate FOREIGN ACCOUNT REPORTING REQUIREMENTS, IRS Needs to Further Develop Risk, Compliance, and Cost Plans, p 8

- ↑ see FFI costs and foreign costs above

- ↑ G.A.O.Report to the Committee on Finance, U.S. Senate FOREIGN ACCOUNT REPORTING REQUIREMENTS, IRS Needs to Further Develop Risk, Compliance, and Cost Plans, p 14

- ↑ Graffy, Colleen (July 17, 2013). "How to Lose Friends, Citizens and Influence". The Wall Street Journal.

- 1 2 3 4 5 6 "Myth vs. FATCA: The Truth About Treasury's Effort To Combat Offshore Tax Evasion".

- ↑ "FATCA may identify tax cheats, but its dragnet for financial criminals may produce an even bigger yield". Association of Certified Financial Crime Specialists. March 1, 2012.

- ↑ Cost-Benefit and Other Analysis Requirements in the Rulemaking Process, Maeve P. Carey, Coordinator, Analyst in Government Organization and Management, December 9, 2014

- ↑ Wood, Robert W. (November 30, 2011). "FATCA Carries Fat Price Tag". Forbes.

- ↑ Much of the tax paid relates to clear instances of double taxation

- ↑ "Scratched by the FATCA". The Economist. November 26, 2011.

- ↑ International Tax Working Group Submissions United States Senate Committee on Finance, "As the United States does not have a wealth tax, reporting of financial information by banks within the United States is limited to the reporting of income, namely, in the case of bank accounts, to interest income earned in any account."

- ↑ International Tax Working Group Submissions United States Senate Committee on Finance, "If the laws were amended to require all American citizens to report all of their bank account balances and financial assets to the IRS every year, America would erupt! Such a law would be an unconstitutional invasion of citizen’s privacy because there is no justifiable government interest in the detailed financial asset levels of American citizens absent probable cause of tax evasion. Clearly, however, requiring all Americans to disclose all of their financial assets to the IRS could be very beneficial to catching tax evasion- just like allowing the warrantless search of everyone’s home could be very beneficial to catching other criminals. But that is not how America works and is not consistent with the protections of the Constitution."

- ↑ "Why FATCA is Bad for America and Why it Should be Repealed". ACA Reports series. American Citizens Abroad. July 19, 2012. Archived from the original on June 1, 2013.

- ↑ USA Today (September 27, 2012). "European banks shut Americans out over U.S. tax rules".Yan, Sophia (September 15, 2013). "Banks lock out Americans over new tax law". CNN.

- ↑ "Americans Abroad Can't Bank Smoothly As FATCA Tax Evasion Reform Comes Into Play". December 20, 2013.

- ↑ Yan, Sophia (September 15, 2013). "Banks lock out Americans over new tax law".

- ↑ "Facing up to FATCA". Deloitte. Fall 2011.

- ↑ Posey, Bill (July 1, 2013). "Letter to Secretary of Treasury" (PDF). repealfatca.com.

- ↑ Browning, Lynnley (September 16, 2013). "Complying With U.S. Tax Evasion Law Is Vexing Foreign Banks". The New York Times.

- ↑ FATCA’s flaws The Economist 28 June 2014

- ↑ http://taxpolicy.ird.govt.nz/sites/default/files/2013-ris-arearm-bill-04.pdf

- ↑ "Liste complète".

- ↑ "Svenska banker letar efter amerikaner".

- ↑ "Google Översätt".